Nick Shugg provides the latest SMSF tables to assess how well client investment portfolios are performing and analyses what asset classes are currently the strongest.

SMSF trustees, advisers, accountants and other industry service providers need to sit up and take note of a shift in the political climate, which could affect them.

SMSF compliance and SMSF performance are opposite sides of the same coin. There is plenty of focus on the compliance side, which the ATO regulates, but until lately there has been very little focus on the performance side. The ATO has neither the mandate nor the resources to focus on this.

The Productivity Commission though has talked about large Australian Prudential Regulation Authority (APRA)-regulated funds being forced to be compared against the top 10 performers and possibly shut down or losing the ability to be a default fund if they underperform.

Well, very recently it has begun making similar noises about SMSFs.

But people have SMSFs because they want control and flexibility. They have different risk profiles, different objectives and they may want to invest in different things compared to an industry super fund.

However this characteristic makes comparisons difficult and benchmarking against large APRA-regulated funds, including industry funds, is inappropriate for SMSFs.

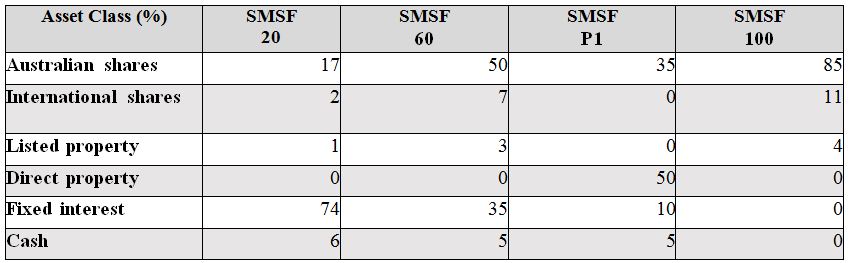

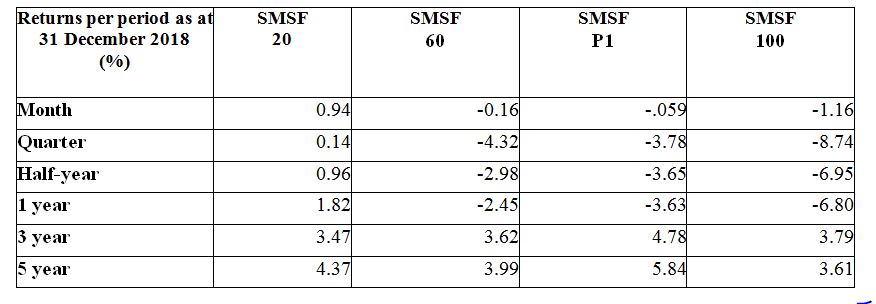

Our full SMSF performance table goes some way to giving trustees a benchmark, where we have 11 benchmark portfolios (model portfolios based on how SMSFs tend to invest).

We are in the process of developing this as a new service and would welcome your feedback as to whether you agree that this would be worthwhile, or not.

Visit [email protected] to register you thoughts.

What’s hot

Although United States shares have come off strongly over the past six months, this sub-asset class has still been one of the top-performing areas over the past 12 months, with a return of 5.9 per cent.

Infrastructure has also been a strong performer, with a return of 5.26 per cent over the 12-month period to 31 December 2018.

Interestingly, after a slump a year ago, Australian government bonds as a sub-asset class have delivered a return of 4.82 per cent over the past year, resulting in defensive funds outperforming the more assertive ones. Sometimes cash really is king.

What’s not

Australian financial stocks continue to drag SMSF returns down. This sub-asset class has delivered a total return of -9.95 per cent over the year (including dividends, but excluding franking credits), compared to -3.07 per cent for the overall market. Would someone please ring the bell and tell me when they have become undervalued.

Oil has fallen 22 per cent over the year and continues to be volatile.

Disclaimer: 1. These Benchmark Portfolios should not be taken as any form of advice. They are designed for information only. Speak to your professional adviser before taking any action. 2. While SMSF Benchmarks Pty Ltd has taken every care in preparation of this information, the company, its directors and/or employees cannot be held responsible for any loss caused by action taken resulting from these benchmark portfolios. 3. Past Returns are no guarantee of future returns.

Nick Shugg is the founder of SMSF Benchmarks.