Individually managed accounts (IMA) and separately managed accounts (SMA) enable SMSF trustees to access direct international and domestic equity portfolios with greater control and transparency compared to the traditional managed fund options, but as investment structures they are not well understood. Hugh MacNally discusses the key differences and benefits of each, and why in his opinion they are meeting SMSF trustee demand.

First, it is important to understand the differences and benefits in relation to IMAs, SMAs, managed funds and other investment structures.

The advantages of IMAs and SMAs over other available investment structures

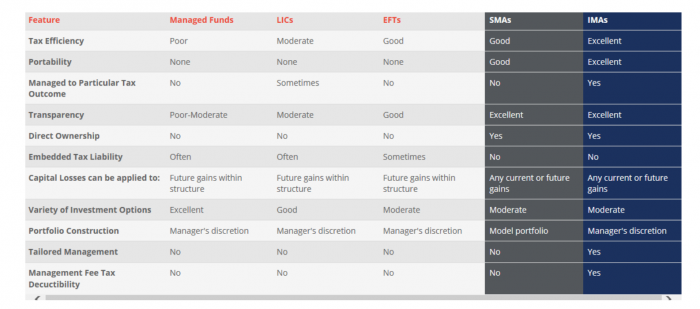

The table below details the key features of IMA, SMA and alterative investment structures. Direct ownership, transparency, cost and tax effectiveness are the core benefits IMAs and SMAs offer for investment management solutions for SMSF trustees.

Key features of SMAs and IMAs compared to other common investment structures

The next question one asks is what is an SMA and an IMA and what are their key differences and benefits.

An SMA is a product where each investor gets the same portfolio.

Under an SMA, a client invests in a model portfolio managed by a professional investment manager. All trading, administration and investment reporting is taken care of for the client by the platform administrator. The client’s financial adviser will assist them in determining whether an SMA is suitable to meet their investment requirements and which portfolio models to select.

There are clear benefits of an SMA for a client.

An SMA provides access to a professional manager and its research capability with the benefits of direct share ownership. Unlike a managed fund, each client is able to see exactly what investments are in their portfolio. Tax events and transaction costs are not shared across clients and the cost base of the client’s investments will be the date of their investment in the model portfolio. Further, a model portfolio is typically a high-conviction portfolio, with the total number of holdings in the model limited to between 20 and 25 securities, whereas the number of securities in a managed fund is typically not specified and is much greater.

Because an SMA model is administered on a platform, the client does not need to manage the trading, corporate actions or any administrative aspects of their portfolio. Clients receive online access to their model portfolio and annual reporting for taxation purposes. The client pays investment management and administration fees.

SMAs are suitable investment products for clients who want a direct investment portfolio without having to spend time selecting, managing and monitoring their portfolios as both the investment management and administration are handled by professionals. International SMAs are particularly relevant for SMSF trustees as they allow direct access to international equities without the complexities and costs of managing international trading, custody and currencies and without the tax consequences of a pooled managed investment.

Private Portfolio Managers (PPM) offers the Australian Equities Growth SMA and Global Equities Growth SMA for both general and superannuation investment.

An IMA is a service where each investor’s portfolio is tailored to their requirements.

An IMA is a discretionary management agreement whereby clients delegate the day-to-day investment decisions and implementation of their chosen investment strategy to an investment manager while retaining the full beneficial ownership of their investments. Their portfolios are bespoke and tailored to each client to meet their investment requirements, taking into consideration their individual preferences, taxation circumstances and investment objectives. A client can transfer into an IMA an existing portfolio ‘in specie’ without triggering any tax consequences and these will be incorporated into individual portfolios and professionally managed.

PPM offers IMA services to clients with an investment of over $500,000 or who otherwise satisfy the Corporations Law definition of a wholesale investor.

The construction of an IMA is a highly personalised service. The portfolio manager will initially meet with the client to discuss their investment objectives, then, in consultation with the client’s advisers, will agree a core investment strategy (including a consideration of growth or income requirements, Australian and/or international equities) and their broader investment requirements. Each client will discuss their taxation status, investment restrictions, environmental, social and governance considerations, and if any existing holdings are to be included in the portfolio via an in-specie transfer. The portfolio manager will then build a portfolio tailored to meet the client’s investment objectives and requirements and actively manage it from that point onwards.

In addition to quarterly and annual reports, the portfolio manager will meet with the client on a regular basis to discuss the portfolio(s) and explain any changes. At PPM, reporting is available online 24/7 via a secure portal on our website.

An actively managed direct portfolio, regardless of whether it is tailored or not, would appear to have more appeal to the SMSF trustee who is seeking a greater level of control, ownership and transparency than a managed fund can offer.

At PPM we have experienced an attraction to SMA and IMA solutions from SMSF trustees because they provide professional investment management, cost-effective administrative ease and the transparency and control they demand.