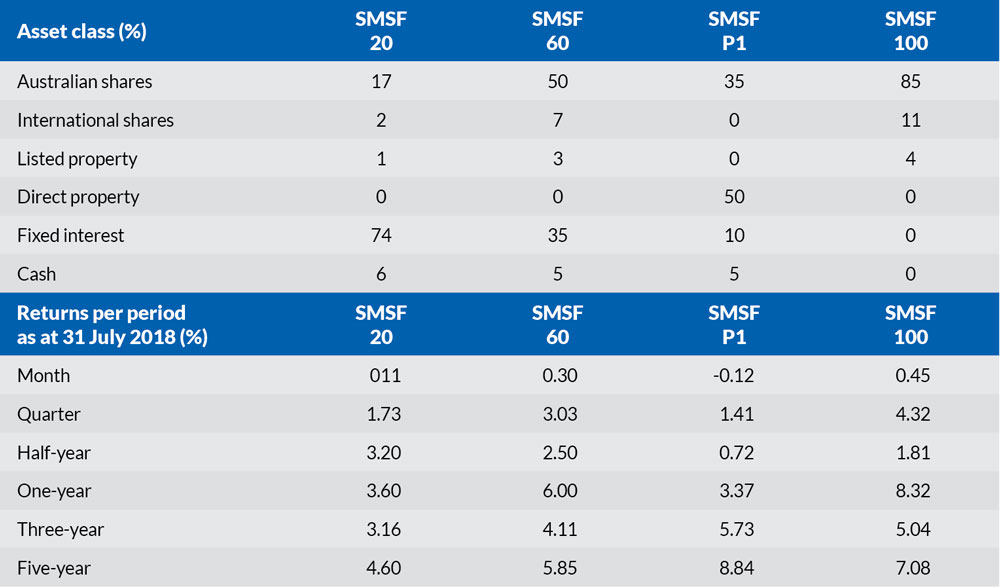

Our SMSF 100 benchmark portfolio returned 8.32 per cent for the 12 months to 31 July 2018. This was significantly higher than our SMSF P2 benchmark portfolio, which is for investors fully in directly owned property. SMSF P2 had a 12-month return of 0.74 per cent as interest rates continued to creep up, causing a crack in the foundations of the Australian residential property market.

Very conservative investors have enjoyed a recovery in Australian government bonds. This sector earned 4.05 per cent over the six months to 31 July, significantly higher than term deposits. At the same time, international government bonds were lower, posting a return of 1.21 per cent over the six months to the end of July, which was similar to term deposits on an annualised basis.

What’s hot

Over the month to 31 July, global healthcare was the healthiest sector, with a return of 6.15 per cent. Over the 12 months to the end of July, this sector was up 16.04 per cent and over the five years to 31 July, it delivered an average return of 14.98 per cent a year.

As this sector is small in Australia, the average self-directed SMSF, which has a lower exposure to global shares compared to the typical advised SMSF, may have missed out on this gain.

There is an academic theory that says small companies are riskier than large ones, so why would you invest in them? The only reason you would is because the market has to price them to give a higher return than large companies, over time, to compensate investors for the extra risk. The theory does not claim it happens all the time.

In this period where the share market has been in an optimistic bull market phase, Australian small companies (as a sub-asset class) delivered a return of 20.51 per cent over the year to 31 July, while the sub-asset class of Australian large companies provided a return of 11.98 per cent.

The outperformance also occurred over the three-year and five-year periods.

This size effect has been even more noticeable in global shares. International small companies delivered a 12-month return of 32.21 per cent compared to the broad global market return of 13.31 per cent (hedged).

What’s not

Asia-ex Japan continued its decrease after a strong showing in recent years. It returned -5.26 per cent over the past quarter.

Oil slid 5.48 per cent over the past month. It is still showing a strong 12-month return of 37.4 per cent, yet the five-year return for this sector is -17.95 per cent annually. Very volatile.

Gold is in a big hole with a return of -9.82 per cent over the six months to 31 July. The five-year average return for the sector was -1.79 per cent.

Disclaimer: 1. These Benchmark Portfolios should not be taken as any form of advice. They are designed for information only. Speak to your professional adviser before taking any action. 2. While SMSF Benchmarks Pty Ltd has taken every care in preparation of this information, the company, its directors and/or employees cannot be held responsible for any loss caused by action taken resulting from these benchmark portfolios. 3. Past returns are no guarantee of future returns.

Nick Shugg is the founder of SMSF Benchmarks.

''