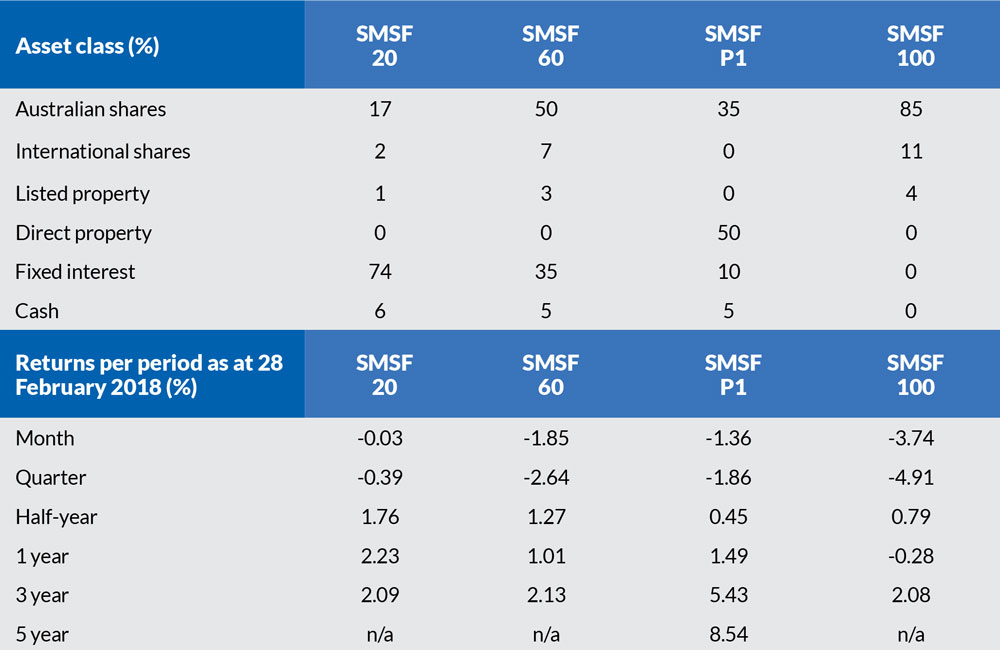

Nick Shugg provides the March 2018 performance tables to facilitate a more meaningful comparison as to how SMSF investment portfolios are performing.

It is hard for SMSF investors to know where to run right now. A chat with a trusted adviser may be a good idea.

In the past month, banks have come under fire at the banking royal commission. This is possibly one reason why the sub-asset class of high-yielding shares and financials have significantly tapered off.

In fact, the Australian financial sector was the worst performing of 26 sub-asset classes we monitor on the Australian Securities Exchange (ASX).

Australian residential property has been falling. The one-year return to January 2018 was 11.21 per cent, while the one-year return to March 2018 was only 3.2 per cent.

Nick Shugg

Across the board, returns have been low for SMSFs, and over the 12 months to March 2018 investors who had full allocations to cash/term deposits/government bonds are likely to have performed better than those with any exposure to Australian shares.

These investors completely committed to cash and cash-equivalent instruments should have earned around 2.9 per cent for the full year to March 2018, and the only SMSF Benchmark portfolio that did better was SMSF P2. These are investors with a 95 per cent portfolio allocation to direct property and 5 per cent to cash and their return over the 12 months was only around 3.15 per cent.

Australian residential property has been falling. The one-year return to January 2018 was 11.21 per cent, while the one-year return to March 2018 was only 3.2 per cent.

Only a few months ago everyone was wanting to avoid government bonds due to their negative returns, but anyone who kept some of their SMSF portfolio in this defensive asset class has protected some of their assets from the recent downturn as fixed income had a positive month.

The one area that has continued to perform strongly is international shares, in which SMSFs tend to have an underexposure.

The question is does that mean European and United States shares are due to come off a fair bit at some stage after five strong years? Bill Gates has recently expressed his opinion that this is a certainty, but he was unable to say when this might happen and he is not an analyst.

Disclaimer: 1. These Benchmark Portfolios should not be taken as any form of advice. They are designed for information only. Speak to your professional adviser before taking any action. 2. While SMSF Benchmarks Pty Ltd has taken every care in the preparation of this information, the company, its directors and/or employees cannot be held responsible for any loss caused by action taken resulting from these benchmark portfolios. 3. Past returns are no guarantee of future returns.

You can read more about the design of our SMSF Benchmark Portfolios in the Knowledge Centre at smsfbenchmarks.com.au.