SMSF trustees have traditionally had limited direct investing access to international equities. Recent times have seen the situation improve with a new way to invest in overseas markets through managed funds now available, Hamish Douglas writes.

SMSF investors are increasingly aware of the benefits associated with portfolio diversification and are looking to allocate a greater portion of their portfolios to international equities.

Although Australian shares have historically been high yielding and benefit from franking credits, the downsides of an excessive home bias (too much of a portfolio concentrated in Australian shares) are well documented.

The Investment Trends “SMSF Report 2014” highlighted that the number of SMSF investors intending to invest in international equities had almost doubled in 12 months.

To date, the limited allocation to international equities by SMSF investors can largely be attributed to the complexities and administrative challenges in accessing overseas equity markets.

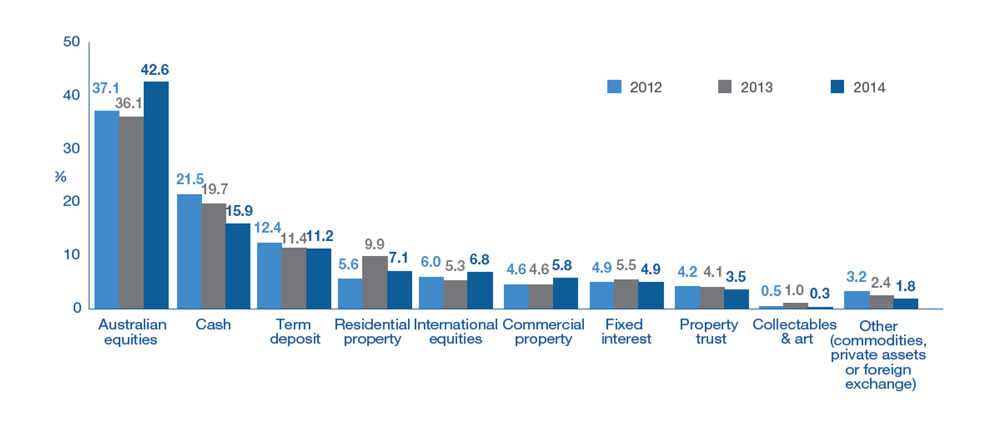

Table 1 demonstrates recent average asset allocations within SMSFs.

Table 1: Recent average asset allocations within SMSFs.

Given this backdrop, investors have welcomed offerings like the Magellan Global Equities Fund (ASX: MGE), the market’s first exchange-quoted managed fund or EQMF.

It is, in short, a relatively new structure through which SMSF and retail investors can get easy access to global equities. In only its first three weeks of trading, the Magellan Global Equities Fund attracted more than 1700 investors and more than doubled in size. Only 19 months later, the fund has more than 12,000 investors.

The argument for asset allocation offshore

There is growing evidence that SMSF trustees remain overly reliant on Australian listed equities and cash. The Australian Taxation Office “Self-managed super fund statistical report June 2016” shows Australian equities and cash made up more than 55 per cent ($356 billion) of the $622 billion of SMSF funds under management.

A low weighting towards international securities reduces diversification and limits exposure to attractive investment opportunities. Statistics based on constituent of the MSCI All Country World Index as at 30 September 2016, the Australian share market makes up only 3 per cent of world equity markets and is heavily weighted towards banks, the resources sector and Telstra. This collectively represents over 55 per cent of the value of the Australian share market based on market capitalisation of the S&P/ASX 200 Index as at 1 November 2016. As a result, investing solely in Australian companies greatly limits exposure to key global investment themes and significant growth opportunities.

By broadening the mix of growth assets to include international shares, SMSF trustees avail themselves to:

- A significantly broader opportunity set with over 2400 stocks across 46 different countries

- Exposure to major global industries like healthcare and technology that are largely under-represented in Australia

- Exposure to major global companies such as Apple, Microsoft, Nestle and Visa

- Diversification through exposure to different economic cycles and currencies.

Accessing global equities on the ASX

Until recently, investors looking for international equities exposure via the Australian Securities Exchange (ASX) had a choice of listed investment companies (LICs), exchange-traded funds (ETFs) and unlisted managed funds through the ASX mFund settlement service.

LICs

LICs have been around in some form since 1868. While they are actively managed and can be traded by investors on the ASX, as a company structure they are closed-ended which means their inability to continuously raise or redeem capital can result in pricing and liquidity issues from some LICs. They can frequently trade at a significant premium or discount to the net asset value.

ETFs

The global exchange-traded product market has been growing at an average rate of 21.5 per cent per annum over the past 10 years, according to the 2016 EY Global ETF Survey. There is now more than US$3.4 trillion in ETF assets and it is the fastest-growing segment of the global funds management market. Surprisingly, less than 1 per cent of these assets are actively managed, as portfolio disclosure requirements continue to be the key obstacle to active managers developing ETF-like products.

ETFs generally have a trust structure, are open-ended and tend to trade with minimal variance to the net asset value due to their ability to continuously raise and redeem capital. They are passively managed and index-linked, reducing flexibility around choice of portfolio holdings.

mFund settlement service

The mFund settlement service is a relatively new platform, having been launched by ASX in 2014. It provides access to unlisted managed funds through CHESS. It eliminates much of the paperwork involved in investing in unlisted funds, but investors do not enjoy the benefits of live pricing and cannot actively trade units in the underlying funds.

Exchange-quoted managed funds

Solving these issues for investors was central to the development of the Magellan Global Equities Fund, an exchange-quoted managed fund (EQMF). The fund combines the actively managed features of unlisted funds and LICs with the open-ended, highly liquid characteristics of ETFs.

The fund was developed with the aim of providing investors with a unique and simple way to gain exposure to Magellan’s high-quality, low-volatility actively managed global equities strategy. The fund is an ASX-quoted version of Magellan’s well performed unlisted Magellan Global Fund but investors enjoy the benefits of live pricing while not being subjected to the administrative burden associated with investing in unlisted funds.

''