Investors navigating the artificial intelligence (AI) landscape should broaden their perspective beyond chip manufacturer Nvidia and explore smaller companies providing vital underlying technologies to power the tech giant’s flagship products, according to an investment manager.

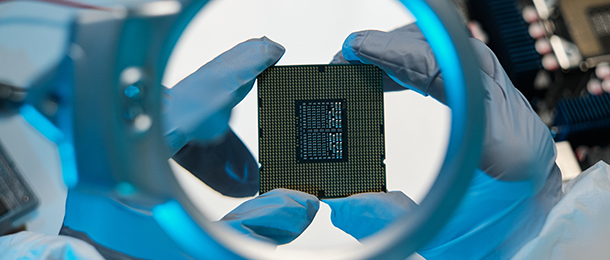

Munro Partners lead portfolio manager Qiao Ma noted Nvidia’s H100 graphics processing unit (GPU) chip is currently considered the most powerful on the market and had resulted in a surge of interest from the investment community because of its utility in supporting the rapid rise of AI technologies.

“It can help to think of Nvidia’s GPU as a dedicated express lane for data, enabling faster information flow compared to traditional memory architecture. This speed boost is crucial for handling the massive data demands of AI tasks,” Ma said.

“Importantly, the H100 features innovative chip stacking. Imagine multiple microprocessors layered on top of each other, working together. This miniaturisation allows for more computer processing power within a compact space, which is crucial for maximising performance and efficiency of GPUs.”

However, she noted Nvidia’s dominance in this space was “more than a solo act” as the chip manufacturer relied on a network of smaller companies for the components of its much-heralded H100 chip.

“[Nvidia’s] memory chips are made by SK Hynix [and] the continued development of advanced chip manufacturing will rely heavily on specialised technologies like BESI’s hybrid bonding and ASMI’s atomic layer deposition,” she said.

“Companies like Onto Innovation and Camtek play a crucial role in this stage, using specialised metrology techniques to ensure everything is perfectly aligned and free of defects. These companies might not be household names, but their contributions are vital to the H100’s success.”

As such, she suggested investors would be wise to take a broader view of the semiconductor supply chain when making allocations to companies involved in supplying AI technologies.

“Munro anticipates the aggressive pace of interest rises will subside in 2024 and in which case we believe it will be a good environment for growth companies such as these semiconductor suppliers, as well as Nvidia,” she said.

''