The technology sector will continue to be a key driver in investment returns in global markets driven by developments in artificial intelligence (AI), with many investors seeing its positive benefits despite the scope for misuse, according to an Axa Investment Managers (IM) senior executive.

Axa IM core investments chief investment officer Chris Iggo indicated earnings for the information technology sector rose quickly during the COVID period, spurred on by purchases related to people working from home, but dipped last year before picking up again based on the expectations of growth from the use and development of AI.

“If you believe in the positive benefits of a technology and that it is going to be productivity enhancing throughout the global economy, then the technology companies at the forefront of the development and scaling up of artificial intelligence are going to benefit,” Iggo explained.

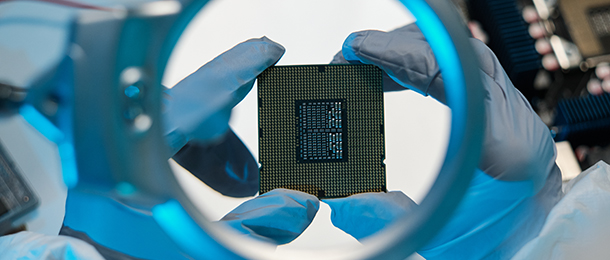

“We’ve seen that in the ‘picks and shovels category’ with some of the semiconductor stocks because to exploit artificial intelligence you need more computing power, which means you need better, more powerful chips and only a few companies in the world are able to produce those.”

He noted there are mixed views on the use of AI, but the widespread nature of its application across sectors such as finance, marketing, automation and healthcare, including the early detection of disease, would create long-term, economic benefits.

“If you are an optimist, you would be on the positive outcomes curve and there is probably an exponential impact of AI on the global economy, just as it was when we got digitalisation in the first tech revolution,” he said.

“There are negative outcomes as well. We’ve heard a lot about AI falling into the wrong hands and being used for malevolent reasons and that machines will take over the world.

“Investors are taking their direction from other previous technology revolutions with the conclusion they were a net benefit to society and this is the view that people are taking about AI at the moment.

“They don’t want to miss out on the valuation implication of this for the big technology players so we have seen a very concentrated performance of the US equity market driven entirely by technology stocks.

“Ten stocks this year are responsible for all of the S&P 500 gains and outside of technology the market is basically flat.

“Banks and energy are down. Industrials and consumer staples are flat and trading in an economic slowdown mode, but technology is on its own run and that will be a long-term thematic.”

''